Why Sydecar is the right choice for Alyssa Arnold, Co-Founder of Pearl Influential Capital

Have you ever wanted to invest in a business but weren’t quite sure where to begin?

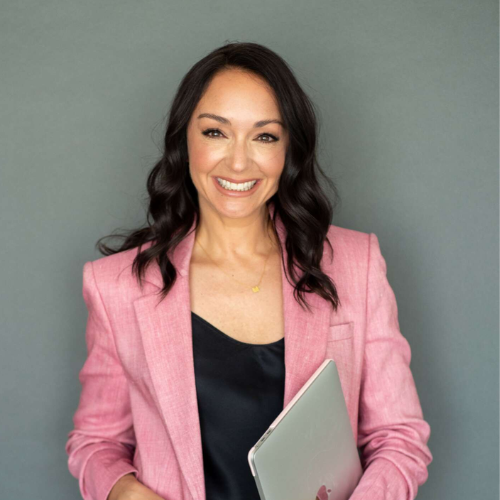

Alyssa Arnold, Co-founder of Pearl Influential Capital, had always dreamed of investing in some of her favorite brands. Now an angel investor, Alyssa has invested in several women-led startups, including Stix and Esker. Working with these startups allows her to support brands she loves and participate in their success.

There are endless draws to angel investing: backing a mission that you believe in, supporting a friend, or simply undertaking the challenge of identifying the best companies. When Alyssa started investing, she was driven by a desire to build her legacy through impact. However, getting started on this mission can feel like an insurmountable challenge. Investing into a startup requires time consuming – and often intimidating – legal and accounting work. With the help of Sydecar, a platform that streamlines the private investing process, Alyssa can stay focused on her goal of building a legacy.

Keep reading to hear more about our conversation with Alyssa as she shares her angel investing tips and how Sydecar can be your “sidekick” for supporting the brands you love.

Why did you start Pearl Influential Capital?

It was always a dream of mine to be able to invest in some of my favorite brands that I use and love. There is something so special about the idea of being able to be a part of these businesses not only by being a customer, but also investing and sharing my expertise with the founding teams.

It took a while to find a way into this world, and it was a bumpy road. Ultimately, I figured it out through connecting with incredible female investors and entrepreneurs. I realized that there was an underground world of opportunities – a world that only people with significant wealth, connections through elite schools, or those who had a career in finance or consumer brands had access to. But why did it have to be this way?

There is a gap in funding for female founders., Female founders typically don’t have the same networks or the access to the Venture Capital (VC) firms that men do. VC firms run by men often don’t understand the problem being solved nor the behavior of women consumers.

aLYSSA ARNOLD, CO-FOUNDER OF PEARL INFLUENTIAL CAPITAL

There are also barriers to angel investing including minimums for direct investment being too high, gaps in knowledge, and access to deal flow.

I was introduced to the SPV model, which allows investors to pool their money to invest in a single company. This allows them to invest with a lower minimum investment. I created Pearl Influential Capital with my partners, Stephanie Cartin, Courtney Spritzer and Ingrid Reed to solve for these barriers, and provide vetted deal flow with lowerminimums, along with education and resources to new and aspiring investors. Together, we are making capital accessible to female founders, and at the same time, giving consumers and brand promoters an opportunity to own, purchase, and support the brands they love. Together, we get these businesses funded faster with influential capital while giving people like you and me the opportunity to be part of it.

For those unfamiliar with SPVs, can you explain more about what they are and the benefits for both investors and founders?

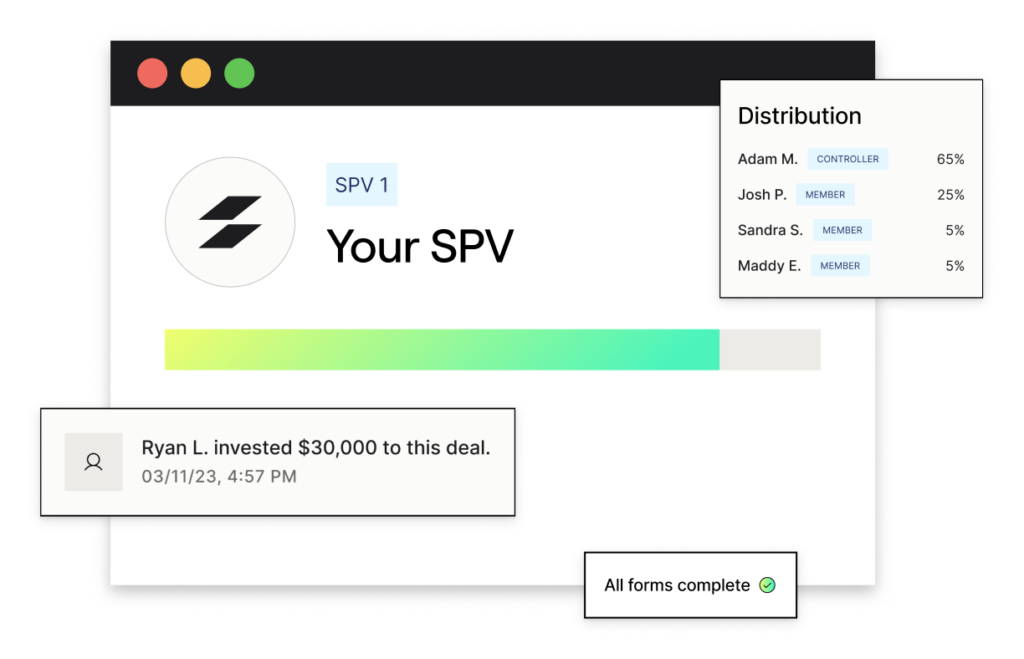

Traditionally, there are two ways to invest in the venture asset class: either through a fund (where the minimum investment is typically $100k+) or by making a direct investment (where the minimum is usually $50k+). SPVs, or syndicates, are a hybrid option which allows a group of angel investors to pool their money allowing individual investors to invest at lower minimums (often times $5k) using individual LLCs. Syndicates give investors the freedom to choose the brands they want to invest in and the lower minimums allow them to invest in more brands and diversify their portfolio. Portfolio diversification is especially important in venture capital as it is a high risk asset class. Sydecar facilitates all the legal and regulatory documentation at low fees to help make SPVs more approachable, accessible, and easier to manage for new and tenured investors alike.

Why did you choose to work with Sydecar to manage your SPV’s for Pearl?

Sydecar is unique in a few different ways. First, their team is incredible and has acted like a partner to me in building my business since day one. They are quick to respond whenever me or my investors have questions, which goes a long way to build confidence. They make me look good to my investors. I also love that Sydecar has a larger vision for the private investment industry that transcends SPVs and venture capital. Their vision and approach to building infrastructure ensures us lifelong partners.

What does it mean to be an angel investor?

The significance of angel investing is truly different for everyone. For me, it began with the desire to build legacy and impact. With 3 young children, I often try to prioritize my time to build toward the legacy I leave behind for them. But I’ve realized that my experience as an angel investor has done so much more than just that. I have also grown as a business owner and become passionate about giving others the opportunity to angel invest and build a legacy.

I’ve used a number of different SPV and investment platforms, and none of them are as secure and intuitive to both myself and the investors. Sydecar has also had the best team to help with all the little details and ensure success.

aLYSSA ARNOLD, CO-FOUNDER OF PEARL INFLUENTIAL CAPITAL

What do you love most about the Sydecar interface and capabilities?

Sydecar has the highest security protocol and the best user interface for the Pearl Community. They have truly created a seamless investment process, and I am able to rest easy knowing only the eyes of my investors are viewing the proprietary documentation about each company we are raising for.

I’ve used a number of different SPV and investment platforms, and none of them are as secure and intuitive to both myself and the investors. Sydecar has also had the best team to help with all the little details and ensure success.

Advice for founders raising capital?

Be prepared to talk to hundreds of potential investors in order to find the right funding option for your business. Finding the right investor is a process, especially in our current macro economic environment.

Before you officially begin raising, I would recommend creating a list of ideal investors. Start with 100 and categorize them in three different tiers. Next,searchi for warm introductions through Linkedin and communities like The Entreprenista League. Warm introductions help kick off a conversation with a potential investor. Lastly, focus on building out your data room. Your data room should include: quarterly investor updates, formation documents, capitalization table, previous raise documents, financials (historical and future predictions), pitch deck, press, insurance policies, key contracts and permits/trademarks/patents.

If you are raising through an SPV, Sydecar has a data room which allows investors to share these key documents in a secure manner.. Entreprenista also has a Raising Capital Power Group for founders that are raising capital if you need support along your fundraising journey.

What advice do you have for investors that are managing SPV’s?

Be patient! Remember that each investor is investing their hard earned money into your deal, so while it may seem repetitive to answer similar questions, it’s important to build trust with your investors and give them your time. Secondly, be open to learning from each of your investors. The time I’ve spent in conversations with our community has made me a better investor through their learnings, questions and experiences.

What’s next for Pearl?

We will continue to build our network of investors and inspire new investors! We also want to continue to be a trusted source of education and resources as well as deal flow for anyone interested in learning about or becoming an angel investor.

If you’re interested in learning more about Pearl Influential Capital and angel investing, you can do so here.

And if you’re looking for a community of founders we invite you to join The Entreprenista League where you can connect you to potential investors and more to help you network and grow your business.

![[Template] Website Member Feature Banner (1) [Template] Website Member Feature Banner (1)](https://entreprenista.com/wp-content/uploads/2024/07/Template-Website-Member-Feature-Banner-1-8.png)

![[Template] Website Member Feature Banner (1) [Template] Website Member Feature Banner (1)](https://entreprenista.com/wp-content/uploads/2024/07/Template-Website-Member-Feature-Banner-1-7.png)

![[Template] Website Member Feature Banner (1) [Template] Website Member Feature Banner (1)](https://entreprenista.com/wp-content/uploads/2024/07/Template-Website-Member-Feature-Banner-1-6.png)

![[Template] Website Member Feature Banner (1) [Template] Website Member Feature Banner (1)](https://entreprenista.com/wp-content/uploads/2024/07/Template-Website-Member-Feature-Banner-1-5.png)

![[Template] Website Member Feature Banner (1) [Template] Website Member Feature Banner (1)](https://entreprenista.com/wp-content/uploads/2024/07/Template-Website-Member-Feature-Banner-1-4.png)

![[Template] Website Member Feature Banner (1) [Template] Website Member Feature Banner (1)](https://entreprenista.com/wp-content/uploads/2024/07/Template-Website-Member-Feature-Banner-1-3.png)

![[Template] Website Member Feature Banner (1) [Template] Website Member Feature Banner (1)](https://entreprenista.com/wp-content/uploads/2024/07/Template-Website-Member-Feature-Banner-1-2.png)

![[Template] Website Member Feature Banner (1) [Template] Website Member Feature Banner (1)](https://entreprenista.com/wp-content/uploads/2024/07/Template-Website-Member-Feature-Banner-1-1.png)